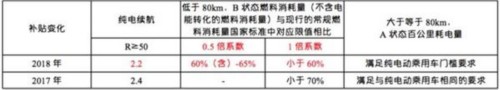

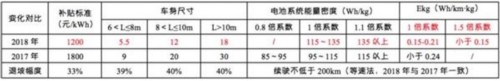

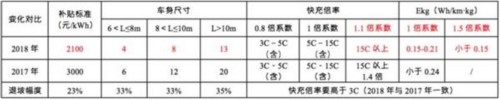

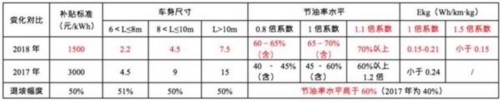

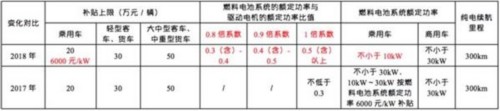

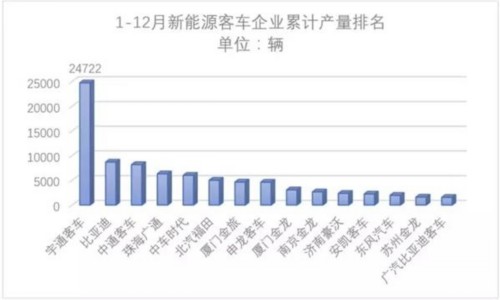

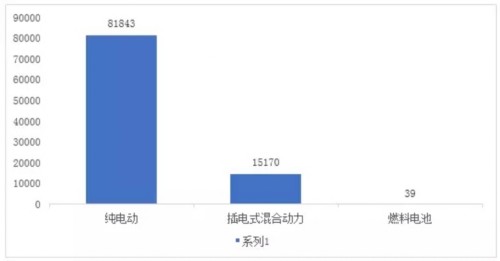

Recently, the industry's long-awaited 18-year subsidy program for new energy vehicles was finally announced. According to the requirements, the new plan will be implemented from February 12, 2018. The period from February 12 to June 11 will be a transitional period. New energy vehicles and passenger cars on board will be executed at 0.7 times the 17-year subsidy standard. New Energy Trucks and special vehicles will be executed at a rate of 0.4 times. The fuel cell vehicle subsidy standard will remain unchanged. From June 12 onwards, subsidies will be formally based on the new subsidy program. As it is a major policy affecting industrial development, involving the future product development, production and sales planning of car companies, the new subsidy policy will inevitably have a significant impact on the industry before and after its release. Plug-in passenger vehicle: subsidy of 22,000 yuan, compared with the 2017 standard (2.4 million yuan) slope down 8.33%, relative adjustment is small. Non-rapidly-charged pure electric buses: the slope reduction rate is about 40%, the battery system energy density threshold is 115kWh/kg from 85kWh/kg, and Ekg is not higher than 0.21Wh/km? Kg. Fast-charged pure electric buses: The grade of slope retreat is about 33~35%, and the requirement of fast recharge rate remains the same, but the adjustment coefficient of “15C or more†is reduced from 1.4 to 1.1. Plug-in hybrid (including incremental) bus: The rate of slope reduction is about 50%, and the fuel-saving rate requirement is greatly increased. New energy trucks and special vehicles: the rate of slope reduction is about 35~43%, the threshold of energy density of the battery system is increased from 90Wh/kgt to 115Wh/kg, and the electricity consumption per 100 kilometer of special electric vehicles for the operation class (by test quality) does not exceed 8kWh . Fuel cell cars: The quota has basically remained unchanged. Comparing the old and new versions, we can see that, with the exception of fuel cell vehicle subsidies, the changes are mainly reflected in two aspects. First, the subsidy standard for optimizing and optimizing new energy passenger vehicles, and second, subsidies for new energy passenger cars and special vehicles. The quota fully retreats about 40%. Due to the fact that new energy vehicles and passenger cars have not yet formed a large market size compared to new energy passenger cars and passenger cars, this policy adjustment has mainly triggered the industry’s concerns about the development of bus companies this year. After all, new energy bus companies still rely mainly on Government subsidies have been able to maintain product promotion and achieve profitability. In terms of car prices, in 2017, Yutong, BYD, and Zhongtong ranked the top three in terms of output scale, with output reaching 24,722 vehicles, 8,688 vehicles, and 8,180 vehicles respectively. At first glance, rushing to install impulse at the end of the year seems to be a strange phenomenon in the development of the new energy bus industry, but it is basically the result of subsidies oriented. From the perspective of product technology, domestic pure electric buses, plug-in hybrid buses, and fuel cell buses coexist. In 2017, the insurance premium for pure electric buses was 81,000, accounting for 84% of the total, which dominated the market. Relatively speaking, there are only 39 fuel cell buses and the fuel cell bus is in its infancy. Therefore, overall, as of 2017, the development of China's new energy bus industry is still heavily dependent on government subsidies. Affected by this key factor, the industry also presents two main characteristics: 1) car companies often collectively rush to install impulse at the end of the year, the “Golden 12 Silver 11′′ market cycle is more and more significant; 2) new energy bus products toward pure Electric (technology is relatively mature), large-scale development. One thing to note is that the overall grade of new energy vehicles in the 17th year is about 20%, and that of the new energy buses in 18 years is 40%. This seems to indicate that this year's bus companies may face a more severe test.

6203, the bearing is a kind of Deep Groove Ball Bearing, 6 represents the category of the type, 2 represents the bearing width level (2 belongs to the light load series), 03 represents the bearing diameter (03 is 17MM, 03 above, each adds a number, for example 0405, the internal diameter method is 04*5=20MM 05*5=25MM, that is 6205 internal diameter is 25MM).

6203 Bearing,Industrial 6203 Bearing,Deep Groove Ball Bearing,Single Row 6203 Bearing LUOYANG AUTO BEARING CO.,LTD , https://www.ballbearing.nl

Before the policy was announced, the industry agreed that the subsidy would drastically degrade. This led to a situation where taxis and bus operators placed orders from the end of last year to January this year, and the full-load production of car companies finally pushed up new energy sources. Automobile production and sales. After the release of the policy, first of all, the growth of the production and sales of new energy vehicles will fall to a normal level in the short period of 2-3 months, and due to the subsidy retreat, the profitability of the car companies in the coming year will inevitably be affected influences.

Subsidy withdrawal, maximum adjustment of new energy buses

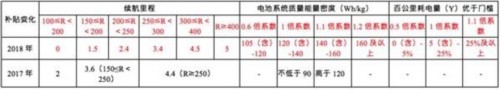

First of all, we will look at the changes in national supplementation for various types of vehicles in 17 and 18 years by means of chart comparisons.

Pure electric passenger car: Adjust and optimize the subsidy standards, the maximum can take 66,000 yuan subsidies, the lowest only 0.45 million yuan subsidy. The battery life threshold is referred to as 150km from the 100km of 17 years, and the battery system energy density refers to 105Wh/kg from 90Wh/kg. The energy density of the battery system and the electricity consumption per hundred kilometers will affect the adjustment coefficient of the pure electric financial subsidy. In the subsidy calculation, the total subsidy coefficient is calculated by the product of the two (maximum 1.32, minimum 0.3).

In addition to the adjustments made by the government, the new subsidy policy also stipulates that new energy vehicle sales will no longer enjoy local purchase subsidies from the 18th, and this part of the original subsidy funds will be transferred to support the construction and operation of charging infrastructure, and new Energy car use and operation and other links.

2017 New Energy Bus Development Review

To analyze whether the subsidy for new energy bus subsidies will have a significant impact on the sub-industry, a detailed review is bound to be made.

At the beginning of 2017, industry insiders once predicted that the production and sales volume of new energy buses last year will be around 70,000 vehicles, which is a lot lower than in previous years (111.6 thousand for 15 years and 135,300 for 16 years). However, at the end of this year, the industry began to circulate news that the 18-year subsidy policy will be drastically reduced. Under the influence of this rumor, the new energy bus industry again appeared at the end of the year.

From the following monthly chart for 2014-2017, it can be seen that the new energy bus market performed poorly in the first 10 months of 2017. In November and December, the sprint was started, and due to the output contribution of the last two months (11 The sum of monthly and December production accounts for 58% of the total annual production in 2017. In 2013, the cumulative production of new energy passenger vehicles reached 105,214, which significantly narrowed the gap between the 15 years and 16 years of production and sales.

Due to frequent reductions in subsidies for new energy vehicles in China in the past two years and continuous improvement in the technical threshold for subsidy applications, such policy changes have led bus companies to collectively accelerate the delivery of new energy vehicles at the end of the 15th and 16th years. Obviously, the purpose of doing so is to catch as many new energy products as possible before the implementation of the new policy so that they can enjoy as much government subsidies as possible under the original subsidy standards.

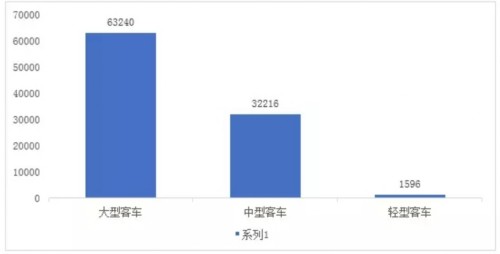

In addition, from the perspective of product structure, mainly domestic and large-scale new energy buses are currently used in China, supplemented by light models. In 2017, the insurance capacity of large-scale new energy buses was approximately 63,200, accounting for 65% of the total. This structural feature is also closely related to the amount of subsidy, as buses with larger bodies usually enjoy more subsidy.

The above analysis is based on the industry. Then, what kind of impact will the subsidy retreat on bus companies have? As mentioned earlier, the subsidy retreat has not happened for the first time. Taking 2017 as an example, the 17 years of new energy subsidies have been reduced by about 20% compared with 16 years. Affected by this situation, some auto companies in the first half of 17 years The income from government subsidies has declined, and among them, the enterprises that run new energy buses are particularly noticeable. Such changes will certainly have a great negative impact on the profitability of enterprises.

Summary: Mid-term car companies are under pressure and have a long-term outlook

Through the above analysis, we can come to the conclusion that the development of new energy buses in China is still heavily dependent on government subsidies. Substantial reduction of this subsidy will inevitably make the future profitability of bus companies more affected.

In terms of intuitive feelings, the subsidy retreat will indeed bring great resistance to the development of the new energy bus industry. However, as far as the investment strategy is concerned, this policy adjustment will have an impact on the industry in the medium and long term. The opportunities for future industries How to look? I think that we should not be overly affected by the short-term policy, but we should dial in to see this issue. After all, investing does not need to be too tangled in short-term fluctuations in stock prices and short-term gains.

Under pressure in the mid-term, the profits of auto companies have been weakened, which has forced technology upgrades. The adjustment of the subsidy policy will exert greater pressure on the production and operation of bus companies in 18 years. According to relevant statistics, in 2017, 80% of sales of new energy vehicles benefited from policies, and government subsidies are still a key source of profit for car companies to promote their products. The subsidy for new energy buses will be substantially reduced by 40%, which will inevitably weaken the profitability of most bus companies in the market. Although in the medium term the profits of auto companies have been undermined, there is another positive signal, that is to say, forcing auto companies to continuously upgrade their technology and accelerate the promotion of the survival of the fittest in the industry, which will benefit leading companies with technological advantages, such as Yutong Bus (600066.SH) and BYD ( 1211.HK) and other industry leaders will enjoy the benefits of future industry concentration.

Long-term optimistic about the leading, new energy commercial vehicle dual-point management system has entered the discussion stage. In recent years, major cities in China have successively accelerated the electrification of public transport, and some provinces and cities have even set the development target of replacing 100% of traditional buses (of which Shenzhen has basically achieved). According to the plans of provinces, municipalities, and autonomous regions, the proportion of new energy buses in newly added and replaced buses will continue to rise. Therefore, from the long-term trend, only the existing huge stocks will replace the market, and the number of years will be cut down. New energy buses must usher in a period of rapid development. From the perspective of policy, with the continuous improvement of product technology, the significant reduction in production costs, and the continuous decline of subsidies in the next three years, new energy buses will continue to weaken due to policy changes. Another good news is that the relevant credit policy for new energy commercial vehicles is under discussion, which may help boost the new energy bus as soon as possible from the policy support and into the demand-driven market. It is to take into account such major industries and policy trends, so we recommend long-term firm determination of leading companies.